Before your child was even born, you were planning. What will we name him? What color should we paint her room? What is the best childcare alternative?But with all the demands and decisions that new parents face, one important aspect is often unintentionally overlooked in those early stages – college. However, with tuition rates rising, it should be at the top of every parent’s planning list … no matter what the child’s age.

What’s more, saving for a child’s education doesn’t necessarily have to rest entirely with parents. With the flexibility and convenience of today’s savings plans, many alternatives make good sense for grandparents, aunts and uncles, other family members and friends, as well as for the child.

You have big dreams for the child in your life. Don’t let a lack of planning sidetrack those aspirations. We’re here to assist. Our knowledge and professional guidance can help you give your child the opportunity for the bright future he or she deserves.

Plan Today for a Brighter Future Tomorrow

Although it is best to start the college investment process when your child is young, it is never too late to begin. No matter your child’s age, what’s important is that you plan now. It is easy to put off thinking about these expenses, hoping that your child will receive scholarships or financial aid. But don’t count on them. While these awards do help with college funding, they are not guaranteed, not always comprehensive and not available to everyone.

Investing for a Younger Child’s Education

If your child is young, then time is on your side. Because you’ll have plenty of time, you may be able to invest less money now and, thanks to the potential impact of compounding returns, let your savings do much of the work for you.

Investing for an Older Child’s Education

Don’t panic if your child is already in high school. While you may need to invest more money in a shorter time frame, you should still be able to afford at least a portion of college costs.

Take a close look at options without specific contribution limits, as they may be more appropriate for you now.

Also, talk to your child about specific goals. What schools is he or she interested in? Is college an option or does your child have his or her sights set on a vocational school? Some plans limit the beneficiary’s choices, so it is important to understand your child’s expectations.

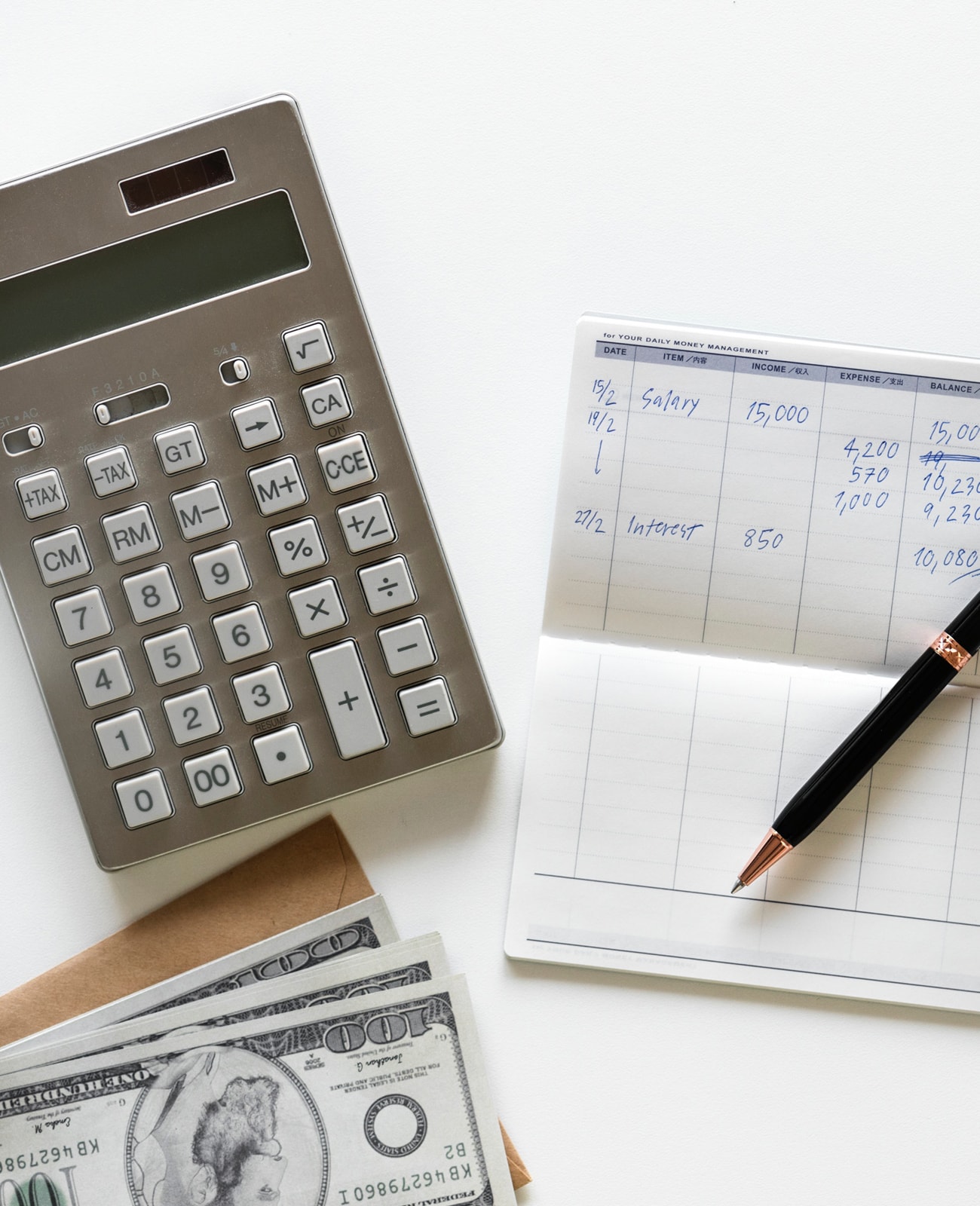

Which Plan is Right for You?

With many new college savings alternatives available, it is critical to choose the one that’s appropriate for you. Selecting the wrong plan – or not investing properly within the right one – can prohibit you from maximizing your savings. However, with the help of our experienced guidance, choosing the right alternative can be easy.

Consider the Following Before Selecting a Plan

- What are the tax benefits?

- Who controls the funds?

- How much risk is involved?

- Are there contribution limits that may hinder your ability to meet savings goals?

- Are large contributions subject to gift taxes?

- What investment options are available?

The following alternatives address these issues with a variety of different savings features.

529 Savings Plans

These state-sponsored plans offer flexible, tax-advantaged ways to save.

Benefits

529 savings plans offer several advantages over other savings plans.

- States may allow contribution deductions from state income taxes.

- Earnings are free from federal taxes if used for qualified education expenses.

- In most states, earnings are free from state taxes if used for qualified education expenses

- You – rather than your child – remain in control of the funds.

- Generous contribution limits exist, regardless of income level.

- You choose the investment strategy that is right for you and your student.

- You can contribute to a 529 savings plan and a Coverdell Education Savings Account during the same year.

- Unused portions of the account may be transferred to another family member.

- Contributions are typically excluded from your taxable estate and may not be subject to gift taxes.

Other Considerations

While 529 savings plans offer many benefits, there are potential drawbacks.

- Earnings are taxed and subject to a 10% penalty when withdrawn for uses other than qualified education expenses.

- The portfolio allocations may only allow for changes once per year or upon a change in beneficiary.

529 Prepaid Plans

These plans allow you to purchase a certain percentage of tuition over time that is guaranteed to be equivalent to the same percentage of tuition in the future. We can assist you in determining if a 529 prepaid plan is available in your state.

Benefits

With tuition rates rising, these plans may be appropriate for some families.

- States may allow contribution deductions from state income taxes.

- Earnings are free from federal taxes if used for qualified higher education expenses.

- Returns are tied to state school tuition increases.

- Funds are not subject to market volatility.

Other Considerations

Consider these plans carefully since there are limitations.

- Earnings are taxed and typically penalties will apply if the funds are not used for education.

- Your child may have limited school choices.

UGMA/UTMA Custodial Accounts (Uniform Gifts/Transfers to Minors Act)

This act allows you to transfer ownership of assets to your child without needing to establish a costlier trust.

Benefits

While not specifically designed for educational funding, these accounts can be advantageous as they allow you to accumulate funds in your child’s name.

- Earnings from these investments may be taxed at your child’s lower rate.

- There are no annual contribution limits, but gifts of more than the current annual exclusion imit may trigger the gift tax.

- Transferring assets may lower the value of your portfolio, thus allowing you to avoid higher taxes.

- You may invest the funds on behalf of your child, but higher-risk investments are prohibited. We can provide you investment advice that suits your goals for your child.

Other Considerations

These accounts are not specific college savings plans, and there are several noteworthy issues to think about.

- You lose control of the funds when the child reaches the age of majority.

- Contributions to the account are irrevocable.

- Your child may use the funds for any purpose.

Coverdell Education Savings Accounts

Formerly known as the “Education IRA,” this savings alternative is a trust or custodial account used for education expenses.

Benefits

Coverdell Education Savings Accounts (ESAs) offer several advantages.

- Earnings are free from federal taxes when withdrawn for qualified education expenses.

- Unlike most other education savings accounts, funds can be used for primary and secondary education in addition to higher education.

- You can contribute to a Coverdell Education Savings Account and a 529 savings plan during the same year.

- You have full investment control.

- Unused portions of the account may be transferred to another family member.

Other Considerations

Before investing in a Coverdell Education Savings Account, consider these points.

- Total contributions are limited.

- Earnings are taxed and subject to a 10% penalty if not used for qualified primary, secondary or higher education purposes.

- Income limitations may prohibit some individuals from contributing.

IRAs

You can withdraw funds from your IRA to pay qualified higher education expenses. While this may seem like a viable savings option, remember that you will be spending your retirement savings. In addition, amounts withdrawn may count as income and affect eligibility for need-based financial aid.

The 10% penalty tax for withdrawals is waived when funds are used for higher education purposes, but the money may still be subject to income taxes.

Typically, if you own a traditional IRA, the full amount will be taxed, while Roth IRAs allow tax-free withdrawals in certain circumstances. Discuss this issue with us to determine if your withdrawal will be subject to taxation.

Company-Sponsored Retirement Plans

You can withdraw funds from your IRA to pay qualified higher education expenses. While this may seem like a viable savings option, remember that you will be spending your retirement savings. In addition, amounts withdrawn may count as income and affect eligibility for need-based financial aid.

The 10% penalty tax for withdrawals is waived when funds are used for higher education purposes, but the money may still be subject to income taxes.

Typically, if you own a traditional IRA, the full amount will be taxed, while Roth IRAs allow tax-free withdrawals in certain circumstances. Discuss this issue with us to determine if your withdrawal will be subject to taxation.

Typically, if you own a traditional IRA, the full amount will be taxed, while Roth IRAs allow tax-free withdrawals in certain circumstances. Discuss this issue with us to determine if your withdrawal will be subject to taxation.

Life Insurance

While the main purpose of life insurance is to provide money to your family after your death, it can also be used to fund higher education expenses. While it is inappropriate to buy a policy for the sole purpose of college savings, the cash value of your whole, variable or universal policy can be used to pay for such expenses. Talk to us for specific guidelines before withdrawing funds, and remember that life insurance is not a college savings plan by nature. Other alternatives can better help you save for these expenses.

We’ll be glad to review your options with you to help determine a plan that best suits your family’s needs.

Put Your Child’s Future First

Your child’s education is important to you. And because of that, it’s also important to us. Our financial advisors listen to your objectives and provide personalized solutions to help you reach them. By putting your investment needs first, we can help you properly plan for a bright future.

The time to plan for your child’s future is today. Contact us for a no-obligation analysis of your college planning alternatives.